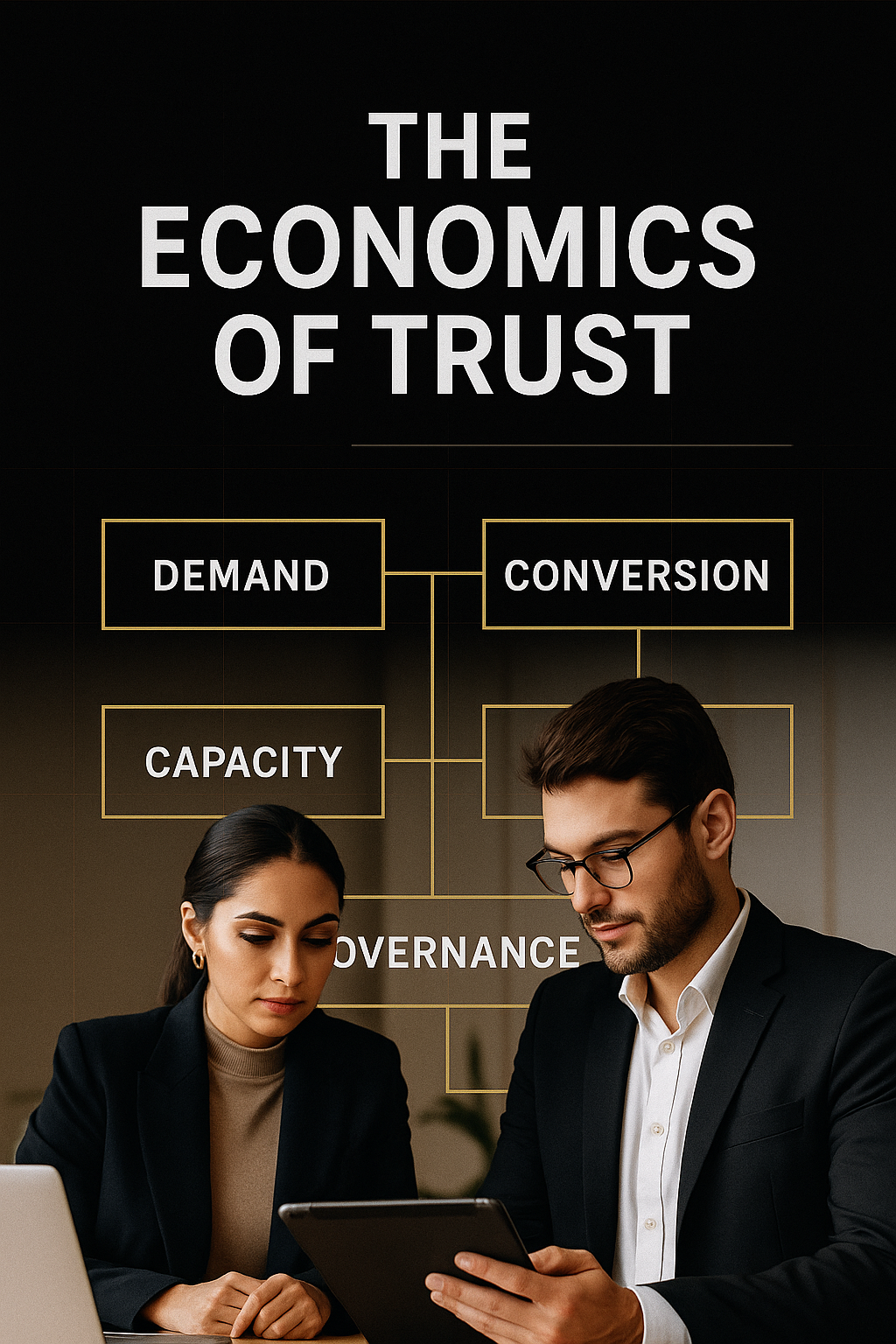

Executive Summary

-

In aesthetics, trust is monetized through unit economics: acquisition efficiency, conversion design, capacity yield, pricing architecture, and governance.

-

Clinics that treat trust as an operating system (not a tagline) see faster CAC payback, higher provider yield, and lower refund/chargeback risk.

-

This playbook defines the metrics, formulas, and governance moves that turn reputation into compounding cash flow.

1) Demand Engine: From Attention to Economically Qualified Leads

Core idea: not all leads are equal; build a funnel that qualifies for intent, spend, and suitability.

Key metrics & formulas

-

LTV = (Avg Gross Margin per Visit) × (Visits per Patient per Year) × (Retention Years)

-

CAC = Total Acquisition Spend ÷ # of New Patients

-

LTV:CAC target: 3:1–6:1 (below 3:1 signals pricing or retention issues; above 6:1 may mean under-investing in growth).

-

Intent Fit Rate = Qualified Consults ÷ Leads

-

No-Show Rate = Missed Consults ÷ Booked Consults (drive it <10% with deposits, confirmations, and calendar nudges).

Moves

-

Engineer lead forms around procedure readiness, budget band, timeline, and contraindications.

-

Split-test consult deposits (refundable at consult) vs. no-deposit; measure no-show delta and patient sentiment.

2) Conversion Architecture: Designing Decisions, Not Discounts

Core idea: a consult is a decision design problem. Codify it.

Conversion ladder

-

Expectation Setting (what’s realistic, not aspirational)

-

Risk Framing (common side effects → probability → mitigation plan)

-

Value Articulation (outcomes, not features; include maintenance logic)

-

Transparent Quote (base + add-ons + maintenance; no hidden fees)

-

Cooling-Off Protocol (ethical safeguard that also reduces refunds)

Key metrics

-

Lead→Consult ≥ 35% (varies by channel)

-

Consult→Treatment ≥ 55% when priced transparently

-

Refund/Chargeback Ratio ≤ 1% of monthly billings

3) Capacity Physics: Turning Hours into Yield

Core idea: revenue is bounded by billable hours × throughput × mix.

Formulas

-

Chair Utilization = Billable Hours ÷ Available Seat Hours (target 70–85%)

-

Provider Yield/Day = Daily Revenue ÷ Provider Days

-

Case Mix Margin = Σ(Procedure Revenue − Direct Consumables − Variable Time Cost)

Moves

-

Slot short, high-margin injectables adjacent to long procedures to smooth the day.

-

Create a “maintenance lane” (15–20 min blocks) to lift utilization without congesting complex cases.

-

Monitor turnover time (room reset + notes + photos). Every 5 minutes saved per case compounds.

4) Pricing Architecture: Confidence, Not Coupons

Core idea: price for outcomes, signal quality, and reduce cognitive load.

Structure

-

Menu Anchors: Good/Better/Best packages (baseline care → enhanced longevity → comprehensive plan).

-

Maintenance Bundles: committed schedules (e.g., 3–4 touchpoints/year) with slight risk-sharing.

-

Clarity Add-ons: analgesia, imaging, aftercare kits listed line-by-line.

Risk Reversal (within governance)

-

Outcome Assure: 14–30 day tweak within clinical reason (not “guarantees” of perfection).

-

Transparent Re-treatment Rules: fixed-fee touch-ups for defined scenarios.

-

No Hard Deadlines for high-risk procedures; prioritize safety over speed.

5) Clinical Governance as a Growth Lever

Core idea: safety systems lower variability, which lowers refunds and fuels reviews.

Non-negotiables

-

Informed Consent 2-Step: digital pre-read + in-clinic verbal confirmation (document both).

-

Complication Pathway: named clinician on call, documented response time SLA, patient info sheet.

-

Photography Protocol: standardized lighting, angles, and timing for before/after integrity.

-

Review Ethics: request reviews post-follow-up, never at payment desk; respond to negatives with process, not defensiveness.

6) Metrics That Matter (Weekly Dashboard)

-

LTV:CAC

-

No-Show Rate

-

Consult→Treatment Rate

-

Chair Utilization

-

Provider Yield/Day

-

Refund/Chargeback Ratio

-

Review Velocity (new reviews/week) & Avg Rating

-

Complication Rate (by procedure) & Time-to-Resolution

Set thresholds, attach owners, and color-code. What gets measured improves.

7) 30–60–90 Day Implementation Plan

Day 0–30

-

Install standard consult script, informed-consent double-step, and photo protocol.

-

Pilot consult deposits + automated reminders; measure no-show change.

-

Publish transparent price menu with bundles and add-ons.

Day 31–60

-

Build the weekly dashboard; set red/amber/green thresholds.

-

Re-engineer schedule: add maintenance lane; benchmark turnover time.

-

Launch Outcome Assure policy with defined tweak rules.

Day 61–90

-

Review case mix margin; re-price low-margin slots or limit scheduling windows.

-

Host a patient education evening; capture qualified leads with pre-assessment.

-

Conduct a governance drill (complication pathway simulation) and debrief.

Conclusion

Trust is not a brand promise—it’s an operating regime. Clinics that codify demand quality, conversion design, capacity physics, pricing clarity, and governance don’t just look premium—they compound outcomes, reputation, and cash flow. That is the competitive moat for 2025 and beyond.